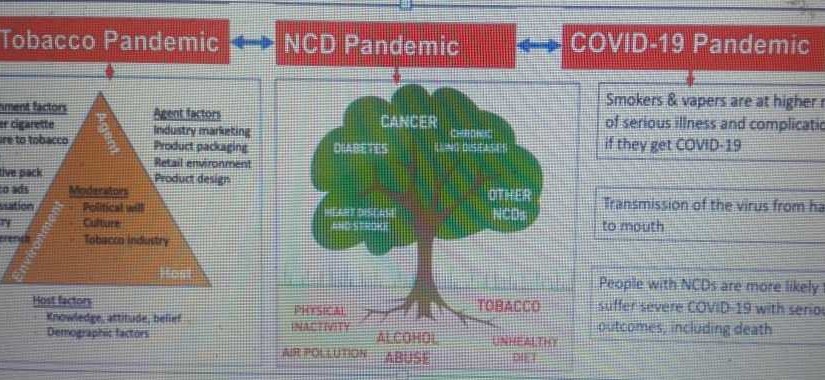

Tobacco is the only consumption product currently that kills the smoker and the non-smoker. To overcome the scourge, World Health Organization (WHO), acknowledges the increase of taxes on tobacco products to reduce consumption and fund health programs.

More taxes, fewer smokers, fewer patients and therefore more productivity and revenue. According to the World Health Organization (WHO), tax increases are interesting for two reasons since they are both good for public health and government revenue. The revenue obtained may be used for health or other public health interest.

Thus, as part of a strategy for prevention and control of NCDs, “Price and tax measures weighing on tobacco products can be an effective and important means of reducing tobacco consumption and thus the costs of health care and the measures could generate a revenue stream that will finance development in many countries”, stressed final document of international conference on finance and development, Which held in Addis-Abeba from the 13th to the 16th July 2015

WHO reports on this subject that the adoption of a law attributing a certain amount or certain percentage of revenue from tobacco taxes to health, enabled in 2014 the Philippines to finance the national health insurance scheme.

Low and middle income countries, the principal market of the tobacco industry, to reduce tobacco consumption therefore benefit from increased excise taxes on tobacco.

(

( (

(